Investors are dealing with unstable markets because of global trade issues, tariff talks, and AI changing industries. Many are choosing bonds to get steady income and protect their investments. Vanguard is a top company in the brokerage business that offers low-cost, well-made funds, including bond funds. These bond funds—like government, corporate, treasury, and tax-free bonds—can help you earn income with usually less risk than stock funds.

What Are Vanguard Fixed Income Funds?

Vanguard fixed income funds are investment groups that mainly buy bonds. They provide income and have low fees. These funds invest in company bonds, U.S. government bonds, and local government bonds. They give you steady income and returns with less risk. These funds are good for retirees and anyone who wants to invest in something other than stocks.

How We Chose These Funds

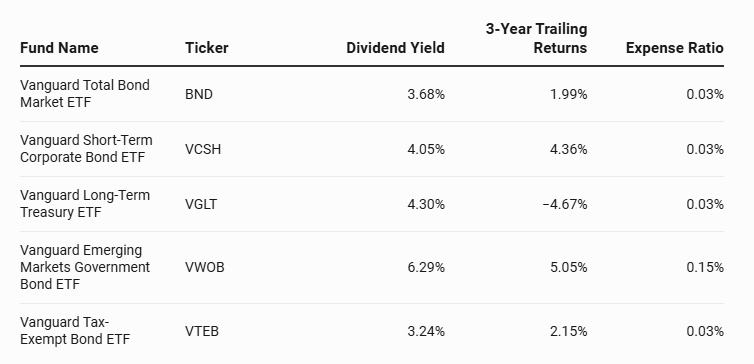

We picked Vanguard bond funds based on their high dividend yield, low cost, and variety of bond types. We looked at how well they did over the last three years, the quality of the bonds they hold, and the size of the fund. All these funds have low fees. Depending on what you want—more income, better past returns, or different types of bonds—you can choose the best fund for you.

5 Vanguard Fixed Income Funds To Earn Income With Lower Risk

1. Vanguard Total Bond Market ETF (BND)

-

Total Money Invested: $352.82 billion

-

Dividend (Income) Yield: 3.68%

-

Return in Last 3 Years: 1.99%

-

Cost to Invest (Expense Ratio): 0.03%

-

Main Bond Types:

-

Highest Quality (AAA): 71.82%

-

U.S. Government Bonds: 51.15%

-

Medium Quality (BBB): 13.09%

-

-

Type: Wide range of U.S. investment-grade bonds

The Vanguard Total Bond Market ETF started in 2007. It is a fund that invests in many different U.S. bonds like government bonds, mortgage bonds, and company bonds. This fund is easy to buy and sell, has many different bonds to reduce risk, costs very little to own, and gives steady income. It is a good choice for investors who want to be careful with their money.

Why BND Is a Great Choice

BND is a popular choice because it covers many types of U.S. bonds, giving you a mix of government and private company bonds. It has mostly high-quality bonds, which makes it good for people who want steady income and low risk, like retirees or careful investors. BND also has very low fees and pays a steady return, helping investors get more from their money.

Vanguard Short-Term Corporate Bond ETF (VCSH)

Fund Details:

-

Total Money Managed: $41.4 billion

-

Dividend Yield: 4.05%

-

Return in Last 3 Years: 4.36%

-

Fees: 0.03%

-

Main Bond Ratings:

-

A: 46.54%

-

BBB: 45.33%

-

AA: 6.88%

-

-

Type: Short-term, good-quality company bonds

This fund started in 2009 and invests in short-term bonds from U.S. companies. It gives over 4% return and has less risk when interest rates change. It is a good choice for people worried about interest rates going up but who still want steady income without big changes in price.

Why VCSH Is a Top Choice

VCSH is popular because it pays a good dividend of 4.05% and is less affected by interest rate changes. It mostly holds high-quality corporate bonds and doesn’t take much risk with how long the bonds last. This makes it good for investors who want steady dividend income without big ups and downs. In the last 3 years, VCSH also earned a higher return of 4.36% compared to similar funds.

3. Vanguard Long-Term Treasury ETF (VGLT)

-

Net Assets: $14.3 billion

-

Dividend Yield: 4.30%

-

3-Year Return: -4.67%

-

Fees: 0.03%

-

Bond Ratings: Mostly U.S. Government bonds, very safe

-

Type: Long-term U.S. Treasury Bonds

VGLT started in 2009 and holds long-term U.S. government bonds that last 10 years or more. Because the bonds last a long time, their prices can go up and down a lot when interest rates change. VGLT does well when rates go down or during uncertain times. It has a high dividend and very low credit risk, making it good for investors who already own a lot of stocks or expect interest rates to drop.

Why VGLT Is a Top Choice

VGLT is good for investors who want to invest in long-term U.S. Treasury bonds and protect against stock market drops or deflation. Even though it had negative returns in the last 3 years, it can provide good income when interest rates fall and has almost no credit risk.

4. Vanguard Emerging Markets Government Bond ETF (VWOB)

-

Net Assets: $5.18 billion

-

Dividend Yield: 6.29%

-

3-Year Return: 5.05%

-

Fees: 0.15%

-

Bond Ratings: Mix of U.S. government and lower-rated emerging market bonds

-

Type: Bonds from emerging countries

VWOB started in 2013 and invests in government bonds from emerging countries. It pays a higher dividend but has more credit risk because these countries’ bonds are less safe. The ETF includes bonds rated BBB and A, and some are in U.S. dollars. It is good for investors who can accept more risk to get higher income and want to invest outside the U.S.

Why VWOB Is a Top Choice

VWOB is a good choice for investors who want higher income and are okay with more risk. It gives good bond diversification by including bonds from many emerging countries.

5. Vanguard Tax-Exempt Bond ETF (VTEB)

-

Net Assets: $38.37 billion

-

Dividend Yield: 3.24%

-

3-Year Return: 2.15%

-

Fees: 0.03%

-

Bond Ratings: Mostly very safe AA and AAA bonds

-

Type: U.S. municipal bonds that are tax-free

VTEB started in 2015 and holds many U.S. municipal bonds that do not require paying federal taxes on income. These bonds come from states and cities and are mostly very safe. This ETF is best for investors with taxable accounts who want tax-free income. It has a good dividend and low fees.

Why VTEB Is a Top Choice

VTEB is great because its income is tax-free federally and it holds mostly high-quality bonds. It’s a smart choice for people who earn a lot and want income in their taxable accounts.

Bottom Line

Vanguard offers many different bond funds for different types of investors. Whether you want a total bond fund, tax-free income, or bonds from emerging markets, Vanguard has options. Their funds have low fees, steady income, and can help add diversity and returns to your investments.

Published: 23th May 2025

For more such articles, please follow us on Twitter, Linkedin & Instagram

Also Read:

Market Volatility: Should Investors Be Worried?

The Power of Small Businesses in a Changing Economy

ETF vs Mutual Fund: Where Should You Invest Now?