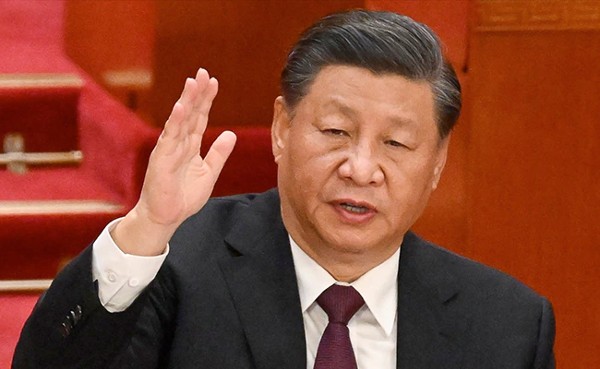

The screenshot asserted that China’s No. 4 official Wang Huning– one of seven men on the powerful Politburo Standing Committee– held a meeting on Sunday of Covid-19 specialists at the demand of President Xi Jinping.

No one is quite sure who created it, when it was composed or if it’s even true. Yet a screenshot of 4 paragraphs describing a China resuming strategy was enough for traders to scoop up supplies for 2 days running.

The unverified article, which contained black characters on a white background without identifying marks, initially started distributing on Monday night in WeChat social messaging groups filled with analysts and also fund supervisors, according to accounts by a loads financiers that asked not to be identified. By the following morning, it was spreading like wildfire.

The screenshot asserted that China’s No. 4 main Wang Huning– among 7 males on the powerful Politburo Standing Board– held a meeting on Sunday of Covid-19 professionals at the request of President Xi Jinping. It called Xi “big manager” as well as made use of “WHN” to refer to Wang in a proposal to avoid censors, that strictly handle messages and also social networks messages on China’s political elite.

It’s rumored that Beijing will soon establish an expert team to put together a “conditional reopening plan.” The goal is to materially reopen the country by March next year. The upcoming 10th edition of covid guideline is widely expected to provide upside surprises. pic.twitter.com/5gwK0tIMCD

— Shanghai Macro Strategist (@ShanghaiMacro) November 1, 2022

Representatives at the meeting, which included members of the financial as well as publicity departments, gone over “quickening a conditional opening strategy, with the goal of significantly opening up by March next year,” it claimed.

The post got more grip when it was shared at 11:26 a.m. by “96 Old Stock Investor” on Xueqiu, a Chinese-language economic platform. Less than 20 minutes later on, noticeable Hong Kong-based financial expert Hong Hao tweeted something similar– as well as supplies in the MSCI China Index were well on their means to a $320 billion rally. Even more gains on Wednesday brought the two-day total amount to $450 billion.

2022-10-31 research: Hot money outflow 2nd worst in history. While HK can see further downside, this is a time when excessive pessimism doesn’t help anyone, and starts to disagree with our contrarian-self. $EWHhttps://t.co/vSAXEPkafa

— Hao HONG 洪灝, CFA (@HAOHONG_CFA) October 30, 2022

Financiers have actually been seeking factors to scoop up Chinese supplies, which are among the most awful performers in the world this year as the economic situation expands near the slowest speed in 4 years. Equities saw a historical rout last week after Xi combined power in a twice-a-decade workers reshuffle, as well as the yuan compromised to a 14-year low.

Covid lockdowns, weak usage and an ailing real estate field have all shadowed the financial investment expectation in China. As well as now that Xi has put his allies in crucial settings, hope is constructing for actions to enhance the economy at the next annual session of China’s legislature in March.

” Reopening is not a decision that can be made overnight,” stated Hong, a companion and primary financial expert at hedge fund Grow Investment Group. “It has to be via cautious study and communication. That is why most of us assume that after the Twin Procedure in March is a great time to resume.”

The episode is an image of exactly how challenging it is to acquire precise details in the world’s second-biggest economic climate, where inner government considerations as well as management modifications are closely secured secrets. That implies huge policy changes can often leakage out in uncommon means, also if they aren’t promptly verifiable.

China has formally stayed mum on the rumors, with state media ignoring them the past two days. A spokesperson for China’s Foreign Ministry stated they weren’t knowledgeable about the rumor throughout a routine press conference on Tuesday, and questions on the subject were scrubbed from the rundown’s authorities records.

On Wednesday, much more rumors were afoot as the rally proceeded. Twitter individual Shanghai Macro Planner, who claims to be a China strategist as well as has more than 14,000 fans, posted screenshots purporting to be from two Chinese brokerage firms reporting upcoming adjustments to China’s Covid policies. The individual decreased to comment further in a message to Bloomberg News.

One screenshot showed Haitong Stocks Co. saying a meeting would be held Friday to reduce quarantine requirements and also get rid of circuit breakers for trips, among other steps. The broker agent stated the screenshot wasn’t real in an emailed respond to Bloomberg News.

The other screenshot cited 3 analysts from Tianfeng Stocks Co. saying that virus controls would be loosened up. When called by Bloomberg Information, all 3 experts said they weren’t familiar with any kind of details concerning Covid policy.

Even as the Communist Party uses little openness as well as badly restricts press freedom, officials in Beijing discouraged investors from checking out way too much right into worldwide media records on China.

” A lot of media reports, allow me place it by doing this, they truly don’t comprehend China very well and also they have a temporary focus,” Fang Xinghai, a vice chairman of the China Stocks Regulatory Compensation, said in prerecorded remarks to Hong Kong’s banking summit on Wednesday. “I would encourage the international capitalists to learn what’s actually taking place in China and also what’s the actual intention of our federal government on their own.”

Disclaimer: TheWorldsTimes (TWT) claims no credit for images featured on our blog site unless otherwise noted. The content used is copyrighted to its respectful owners and authors also we have given the resource link to the original sources whenever possible. If you still think that we have missed something, you can email us directly at theworldstimes@gmail.com and we will be removing that promptly. If you own the rights to any of the images and do not wish them to appear on TheWorldsTimes, please contact us and they will be promptly removed. We believe in providing proper attribution to the original author, artist, or photographer.

Resources: NDTV

Last Updated: 2 November 2022