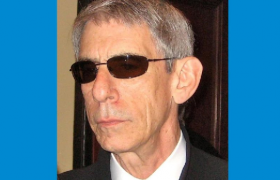

The trading sector is a great field for those who want to add an element of freedom to their professional life, but not everyone succeeds in following this path. Over the past 40 years, exceptional leaders like Jason Sen have reached new heights in their professions. He is the Founder and Technical Analyst at daytradeideas.co.uk and also the Co-Founder of Intelligent AI Solutions.

In this exclusive interview, Jason shares his career trajectory and opens up about the factors of starting and being a successful leader in this field.

Join us as we delve deeper into the mind and vision of Jason Sen, a revolutionary leader marking a change in the field of trading.

The Beginning

We were eager to learn about Jason Sen’s start in this profession. So, we asked, “Can you walk us through your professional journey, highlighting key milestones that have shaped your career?”

Jason said, “I started my career in financial markets in 1987 at the age of only 19 years in the City of London financial district. I was hired as a trainee derivatives broker for a merchant bank, working on the floor of the London Stock Exchange. The traded options market was growing rapidly and I was immediately trained to take orders from other banks over the phone and give them to the dealers who executed the orders in the open outcry pits.

In 1988 I was lucky enough to move to an independent market-making company on the same trading floor where I was trained to take risks and run positions. To me, this was an opportunity to earn an unlimited salary as my deal was performance-based. However, it took me over 2 years before I began to become profitable in such a highly competitive industry, where you stand shoulder to shoulder and fight to trade with the broker.

He added, “In the early 1990s I moved over to the intense trading environment of the London International Financial Futures Exchange. This was where complex fixed-income futures and options were traded (derivatives), such as government bond contracts in several open outcry pits. There were thousands of traders and brokers in brightly colored jackets, all shouting and using hand signals to trade frantically and aggressively.

Every day was filled with adrenaline-fueled risk-taking relying solely on my guts and lightning reactions. My mind was constantly making fast calculations as I screamed across the pit fighting for trades. At the turn of the millennium, I made the transition to screen trading as the trading floors closed and digital trading was born.

In 2007, I established my business daytradeideas.co.uk to provide technical analysis and signals for major investment banks. I now provide these services as well as education and training to retail traders who can benefit from my experience of almost 40 years trading in financial markets.”

Spark Behind The Profession

We also wanted to know more about his decision to be in the field. So, we further asked, “What was the driving force behind your decision to join this sector?”

Jason added, “In my teenage years I simply wanted an exciting career and the potential to earn a lot of money, like many teenagers! In the 1980s the Internet didn’t exist so a career in financial markets in the City of London was one of the few opportunities to fulfill my dream.

I was inspired by my father who was one of the original day traders, trading from home with his funds. He would build charts of the FTSE100 on his office wall using a pencil & graph paper in the early 1980s because technical analysis software did not exist. Home computers barely existed. I was lucky to join the financial markets when they were growing and developing very rapidly.”

On Being A Successful Leader

Curious to gather Jason Sen’s insights on what it takes to be a successful industry leader, we inquired, “In your opinion, what qualities make a successful leader in your industry?”

Jason shared, “There are several elements that build a good industry leader, including:

- Exceptional self-discipline; the most successful traders control their reactions and emotions.

- Patience in building a trading strategy and the ability to make a plan for each trade, according to the rules of the strategy and stick to it.

- The most successful traders do not trade spontaneously. They plan every trade and adhere rigidly to the plan to build a data set which then allows them to optimize the strategy.

- The more trades you have, the greater the opportunity to optimize the strategy.”

Adaptability To The Recent Developments

Eager to delve into the trading journey of Jason Sen, we asked, “How has your organization responded to the ongoing digital revolution and tech-driven changes?”

He passionately shared, “I began trading in 1987 when analog trades were executed in an open outcry trading pits, on a trading floor and the trades were recorded by each counterparty using a pencil and card!! So I have adapted through over almost 40 years of trading to the modern technological age.

Words Of Wisdom For Beginner Traders

Addressing the beginners in the field of trading, we asked, “What advice would you give to someone just starting in your field?”

Jason shared, “If one can become successful at trading it can lead to a life where you are free to make your own decisions and choices. It allows you to travel the world or make significant sums of money. However, the path to success is long and frustrating. There’s no shortcut.

There are 3 important steps to succeed in this field. Firstly, you must learn to identify trends and low-risk trading opportunities as the first step in developing a robust trading strategy. However, building the ability to identify great trade ideas is only the start.”

He further added, “Secondly, you must then learn to exercise strict trade management, risk management, and account management techniques to limit losses and maximize gains. Following these rules is the only way to build the discipline and patience required for longer-term success. And thirdly, once you understand the rules of trading you must master trading psychology.

The best traders in the world have spent a long time mastering their trading psychology to eliminate the emotional roller coaster that leads inexperienced traders to sabotage their account which leads to severe setbacks.”

Worth-Sharing Piece Of Wisdom

Lastly, to learn about a piece of advice that has stayed with Jason Sen forever, we asked, “As a parting thought, what’s the best piece of career advice you’ve ever received?”

“The first cut is the cheapest. Get out of your losses while they are still under your control and move on to the next trading opportunity. This allows you to avoid spiraling into a negative mindset and avoid sustaining large losses.” Jason concluded.

Follow Jason Sen on LinkedIn.

Also Read:

Marking A Difference Via Technology Consulting With Advix: Sergey Kubasov

Architectural Insights: Exploring Alia Beyg’s Journey from architecture school to AQUA Architecture

Wasan Badar Al Malki from Oman’s Entrepreneurial Aspirations to Global Innovations and SME Empowerment