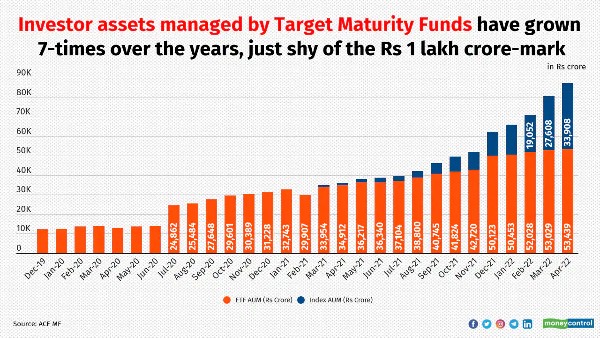

As bond yields climb, investors can make use of target maturity funds to secure their financial investments at higher yields

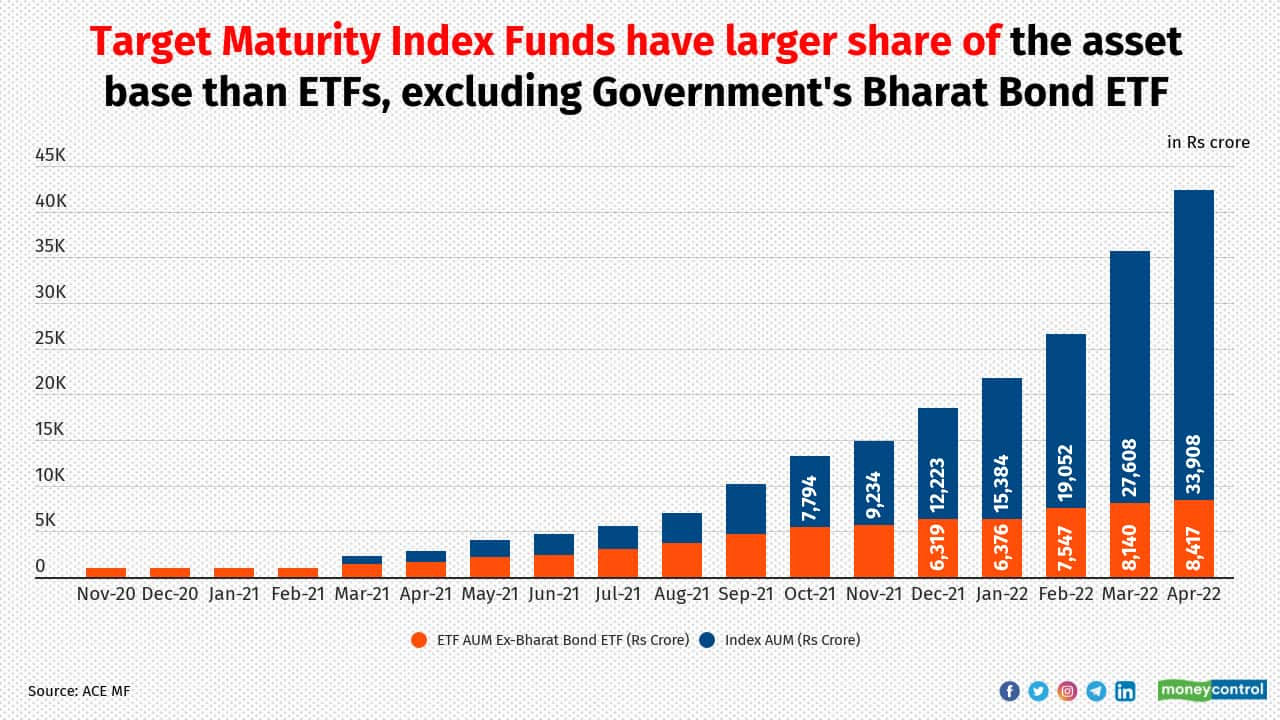

Target Maturity Funds have actually expanded significantly over the last couple of years after the federal government introduced Bharat Bond ETF (handled by Edelweiss Mutual Fund) back in December 2019, which became the nation’s first target maturation fund. In addition to ETFs, currently there are additionally a number of index target maturity funds. While target maturity funds have actually a taken care of maturation date, which is when the plan and also its portfolio financial investments grow, financiers can make early withdrawals as these are open-end funds. Nonetheless, it is advisable to stick till the maturation of the fund, to get returns closer to the fund’s accept maturation. As rate of interest rise, capitalists can utilize such funds to lock-in their financial investments at greater returns.

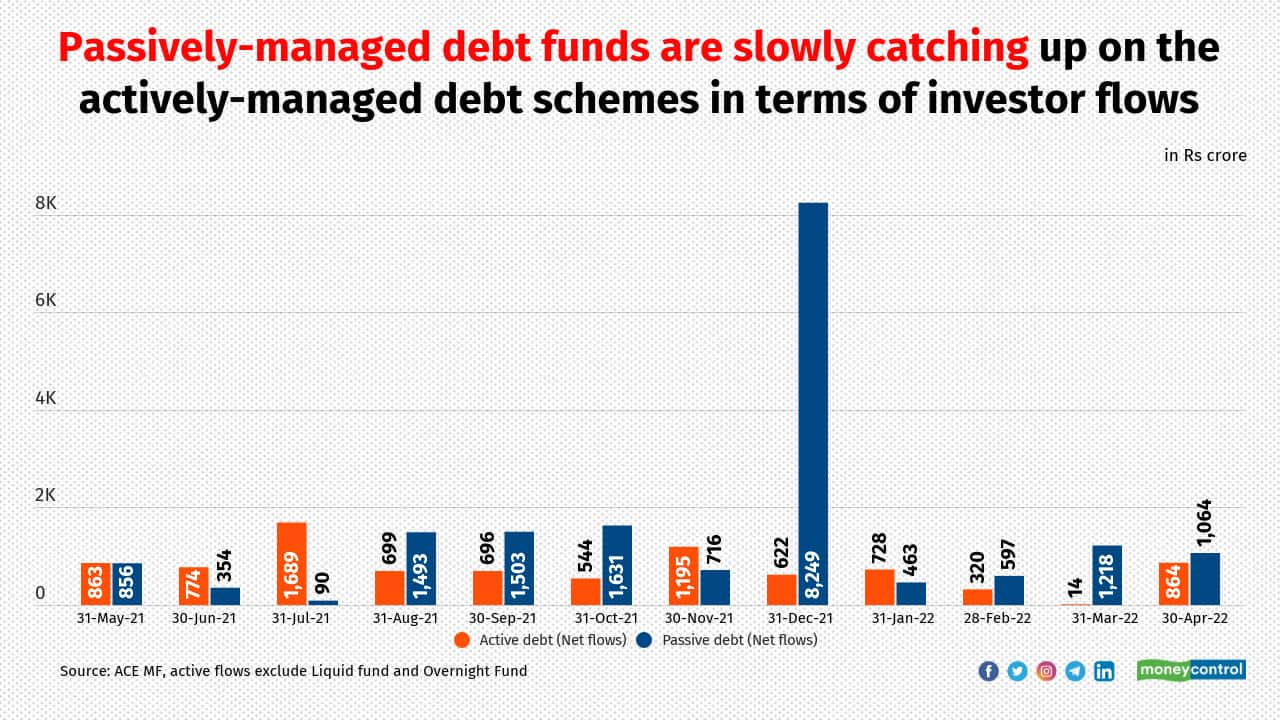

There has actually been a choice for passively-managed target maturation funds among capitalists in recent months. Industry resources claim that post-Franklin Templeton situation, there have been issues on the credit score high quality of the profiles of actively-managed funds. On the other hand, the portfolio of passively-managed target maturity funds are well-known as these are linked either index of bonds of state growth fundings or Federal government safeties or a combined index of the two. Likewise, there is more return predictability as the fund targets at giving returns better to the yield to maturation of the index, if the investor holds the fund till its maturation.

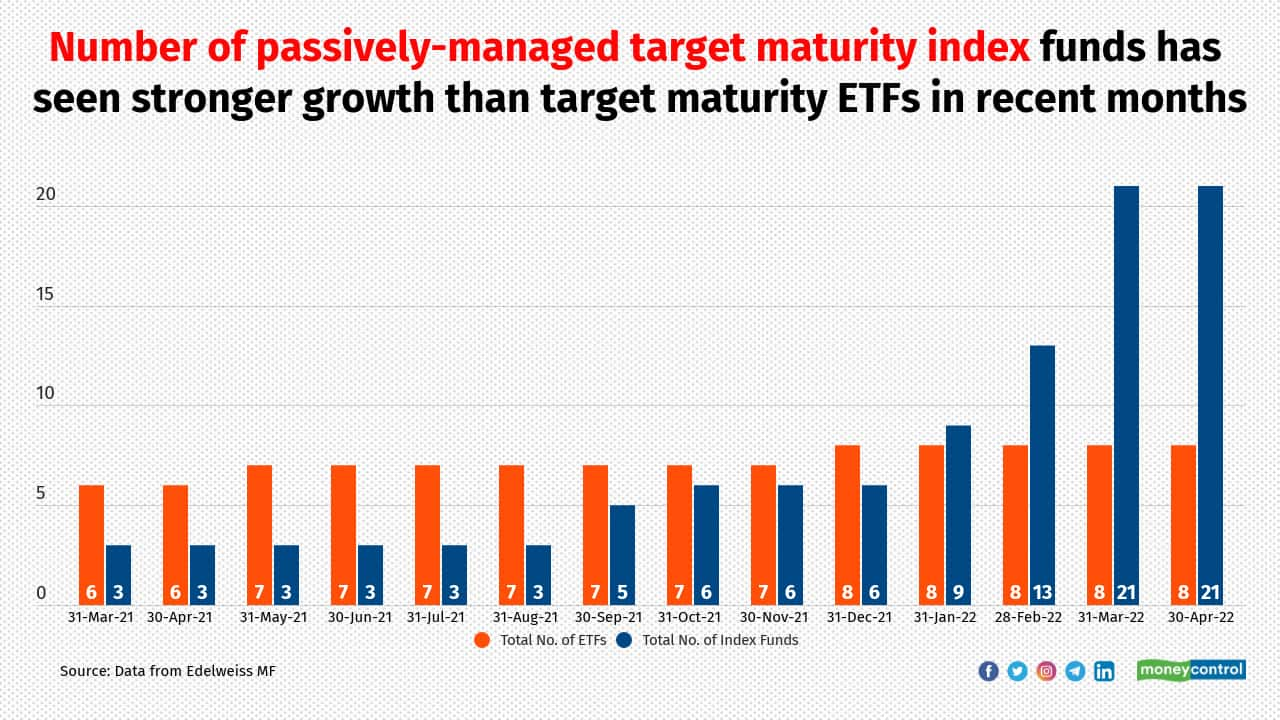

Common funds have launched extra index-based target maturity funds, as all ETFs may not have the ability to produce enough liquidity on the stock market and also there can be larger deviations in the executed rate and also the intraday NAV (iNav) of the ETF. The brand-new SEBI guidelines for easy funds are focused on restoring liquidity for ETFs on the exchanges, as new guidelines mention that no purchase below Rs 25 Crore can be settled directly with the AMC. All such purchases have to be transmitted through exchanges. SEBI additionally intends to create the market-making environment by incentivising market-makers that give liquidity for ETFs.

To buy ETFs, capitalists require demat accounts. There is no need for capitalists to have a demat account to invest in an index fund.

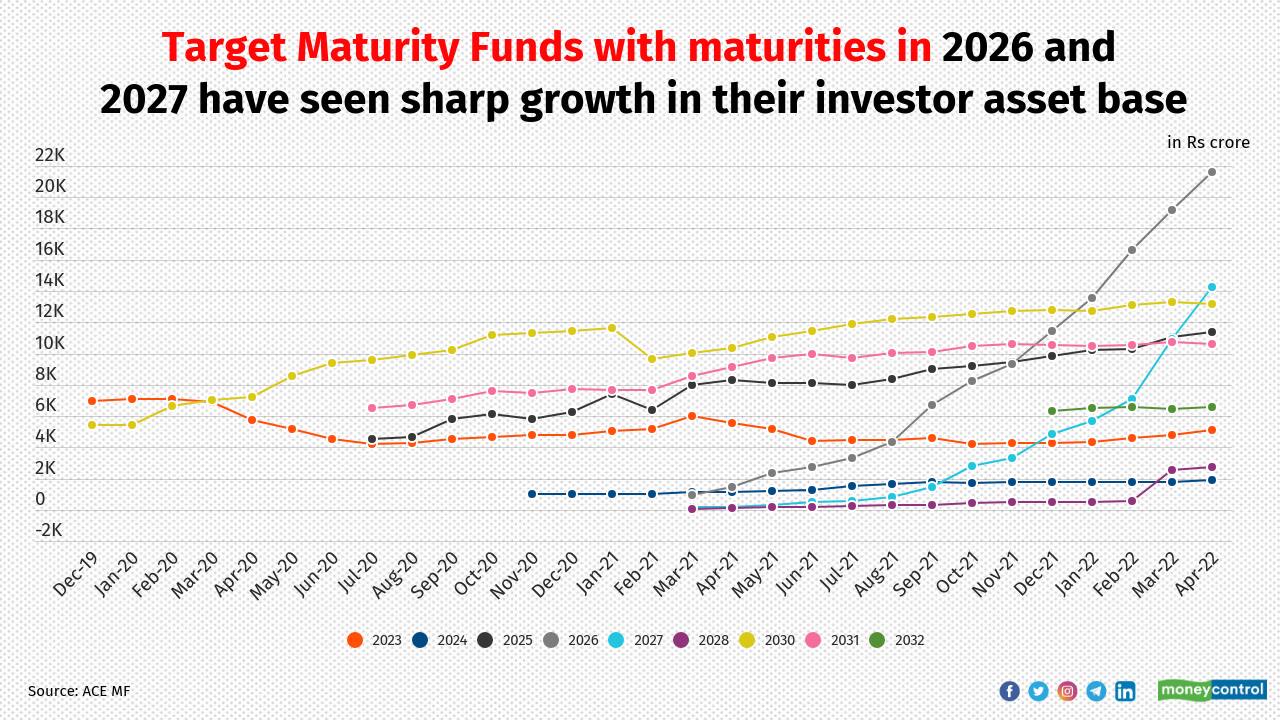

Target Maturation Finances with 2026-2027 maturity have seen lot of passion from financiers. Financial planners are suggesting this maturation sector to investors for tax indexation advantage, as well as maximum returns. Both these maturations are presently supplying returns of 7.48 percent-7.55 percent, respectively. “Past these maturities, like 2028 and also 2029 are reasonably illiquid sectors,” said a debt fund supervisor.

Disclaimer: TheWorldsTimes (TWT) claims no credit for images featured on our blog site unless otherwise noted. The content used is copyrighted to its respectful owners and authors also we have given the resource link to the original sources whenever possible. If you still think that we have missed something, you can email us directly at theworldstimes@gmail.com and we will be removing that promptly. If you own the rights to any of the images and do not wish them to appear on TheWorldsTimes, please contact us and they will be promptly removed. We believe in providing proper attribution to the original author, artist, or photographer.

Resources: Moneycontrol

Last Updated: 10 June 2022