TVS Motor has given a breakout of an Upside down Head & Shoulder pattern on the once a week charts. The stock has actually maintained at 5 months high, suggesting favorable touch of the stock. On the daily graphes, the supply is maintaining higher leading higher lower formation.

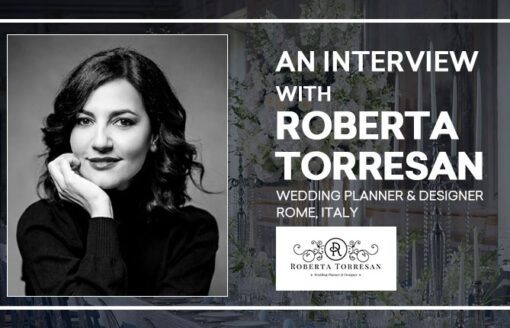

Vidnyan Sawant, AVP – Technical Research at GEPL Capital

Given that the last 3 weeks, the Nifty50 has been moving in a range of 15,730– 16,400. The Nifty is sustaining at 23.6 percent Fibonacci retracement degree of previous advance from the 7,511– 18,604 degrees. On the daily graphes, it has managed to remain above the 16,000 mark because last 5 days which reveals first sign of short term bottoming out.

On the indication front, the RSI (family member toughness index) plotted on the day-to-day graphes is maintaining over 40 mark as well as making higher leading greater bottom development which reveals favorable energy for the short-term.

The Nifty has instant resistance positioned at 16,400 and also 16,800, adhered to by 17,105 levels. The drawback support for the index is placed at 16,000, 15,671, adhered to by 15,450 degrees.

We really feel that the Nifty is in bounce back mode. If the Nifty maintains over 16,400 mark, then it will certainly move in the direction of 16,800 mark in coming days. Our positive view will certainly be negated if it sustains below 16,000 mark.

HDFC has actually taken a strong assistance near Rs 2,060 – 2,100 levels with the development of Dual Bottom pattern which is 61.8 percent Fibonacci retracement degree of previous breakthrough from Rs 1,473 to Rs 3,021 levels. The stock is currently trading near five-week high indicator positive beliefs of the stock.

On the everyday charts, the stock is offering outbreak of Cup and Take care of pattern at Rs 2,265 degrees.

On the indication front, the RSI plotted on the day-to-day time frame has actually endured over 55 mark with a higher top higher lower pattern, showing increasing favorable energy in the prices.

Proceeding, we anticipate the costs to relocate at greater levels towards Rs 2,370, article which we might see an action towards Rs 2,565 degrees. We recommend a stop-loss of Rs 2,190 on everyday closing basis.

TVS Motor Company: Buy | LTP: Rs 708.30 | Stop-Loss: Rs 660 | Target: Rs 813 | Return: 15 percent

TVS Electric motor has actually given a breakout of an Inverted Head & Shoulder pattern on the regular graphes. The supply has actually sustained at 5 months high, suggesting favorable undertone of the supply.

On the everyday graphes, the supply is preserving higher top greater bottom development.

On the indicator front, the RSI plotted on at all times frame is sustaining over 60 degrees which reveals solid favorable momentum.

Going ahead we could see the prices move greater towards Rs 760 mark. If the rates take care of to receive over Rs 760 mark we could see better up relocation in the direction of Rs 813 level.

We suggest a stringent stop-loss of Rs 660 on day-to-day closing basis.

ICICI Bank: Buy | LTP: Rs 728.50 | Stop-Loss: Rs 680 | Target: Rs 835 | Return: 15 percent

ICICI Financial institution has actually bottomed out at Rs 675 degrees with dual lower price formation as well as CIP development (Change in Polarity). The stock is sustaining at 3 weeks high with volume confirmation. On the day-to-day charts, the supply has maintained above 50 days SMA (easy moving average – Rs 726).

The RSI indicator plotted on the once a week charts is relocating upward and also it is maintaining over 50 mark with the formation of higher top greater lower indicating solid positive momentum of the stock.

We expect the supply to relocate higher in the direction of Rs 777 and also if it manages to go across over Rs 777 then at some point it will relocate towards Rs 835 levels.

One ought to keep a strict stop-loss of Rs 680 on day-to-day closing basis for this trade.

Disclaimer: TheWorldsTimes (TWT) claims no credit for images featured on our blog site unless otherwise noted. The content used is copyrighted to its respectful owners and authors also we have given the resource link to the original sources whenever possible. If you still think that we have missed something, you can email us directly at theworldstimes@gmail.com and we will be removing that promptly. If you own the rights to any of the images and do not wish them to appear on TheWorldsTimes, please contact us and they will be promptly removed. We believe in providing proper attribution to the original author, artist, or photographer.

Resources: NDTV

Last Updated: 27 May 2022